Solutions

A breakthrough in handling financial crime alerts

Resolve financial crime alerts with your customers, quickly and efficiently.

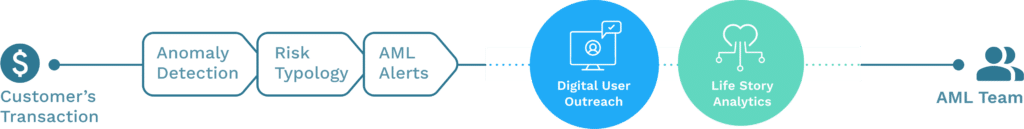

Refine Intelligence introduces a new paradigm in fighting financial crime alerts: partner with your customers to resolve them.

Most alerts are sparked by legitimate activity like selling real estate, paying for renovations or sending a kid to college. Throughout history, banks had personal insights into their customers’ life patterns, but with growth and digital transformation banks have gradually lost that level of familiarity with the individual customer. Refine helps them regain that ‘superpower’ by enabling quick, efficient digital outreach that engages customers about their transactions, to prevent check fraud, money laundering and other financial crimes.