Solutions

Fraudsters now wield advanced AI and deepfake tools to launch large-scale, highly convincing attacks.

From check fraud to account takeovers and sophisticated scams, fraud teams face a crushing volume of alerts—and often lack the customer context needed to explain anomalies. Yet banks hesitate to reach out, since calling customers is slow, high-friction, and yields poor results.

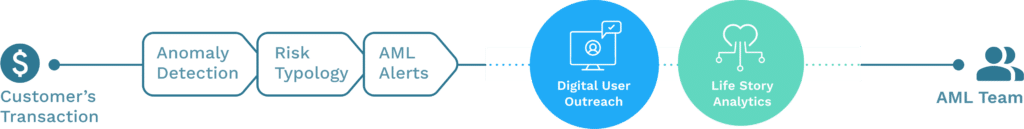

Refine changes that equation. It automatically engages customers across their preferred channels, guiding them through a simple digital interaction and instantly delivering their responses to the bank. For alerts related to potential check fraud or account takeover, customers can decide if the bank should pay; for complex scams, Refine’s patent-pending customer-powered AI validates their responses.