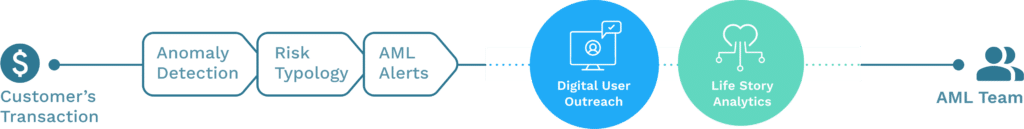

Understand the life stories behind each alert, quickly and efficiently

Refine Intelligence introduces a new paradigm in AML: instead of investigating all anomalies that could have been done by Bad Guys, first establish which of those anomalies were clearly done by Good Guys.

Most alerts are sparked by legitimate activity like selling real estate, paying for renovations or sending a kid to college. Throughout history, banks had personal insights into their customers’ life patterns, but with growth and digital transformation banks have gradually lost that level of familiarity with the individual customer. Refine helps them regain that ‘super power’ so they can recognize what lies behind changes in financial activity.

©2024 Refine Intelligence