Digital Customer Outreach

for AML Investigation Teams

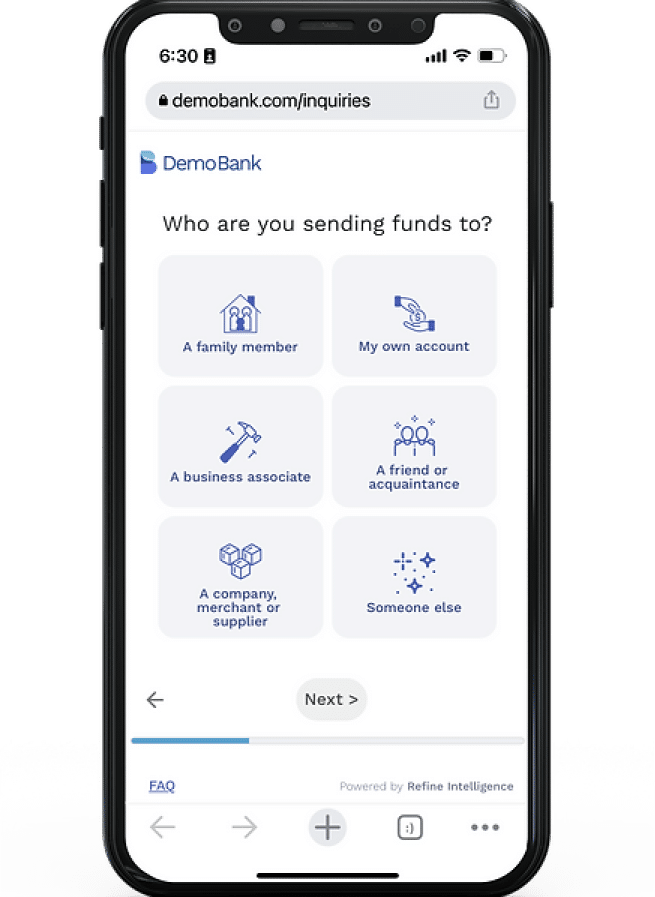

Currently, bank outreach to customers is highly inefficient. Manual outreach via the branch, for instance, takes 16 days on average and 3.6 internal back-and-forth emails to receive a response for a flagged activity, and the process is high-friction, bias-prone, inconsistent and rarely tracked. Refine replaces that process with an automated, 100% consistent digital outreach that goes directly to the customer.

2 Min Response

instead of 2 weeks

Offloads 60%

RFI work from Line of Business

More Explainability

means less risk

Benefits

- Boost completion rates to 85%

- Complete AML outreaches in two minutes

- Receive results instantly in a clear audit trail

- Ensure consistent, objective, structured questions

- Avoid bias, tipping-off risks, and customer friction