Most AML alerts represent anomalies triggered by a perfectly legitimate customer life story. One of the most prevalent explanations that genuine customers provide for anomalous activity that raises red flags is receiving or sending a gift. But when we looked at the data for gift-related transfer, we found a very odd discrepancy…

When asked to explain a cash transaction, one of the top 5 life stories genuine customers provide is receiving or giving a gift.

A “Gift In” situation is when a large deposit – often in cash – is explained by the customer as a gift. A “Gift Out” situation is when the customer draws a large amount of cash or transfers a high amount of money, and explains that it was done in order to give a gift, typically to friends or family.

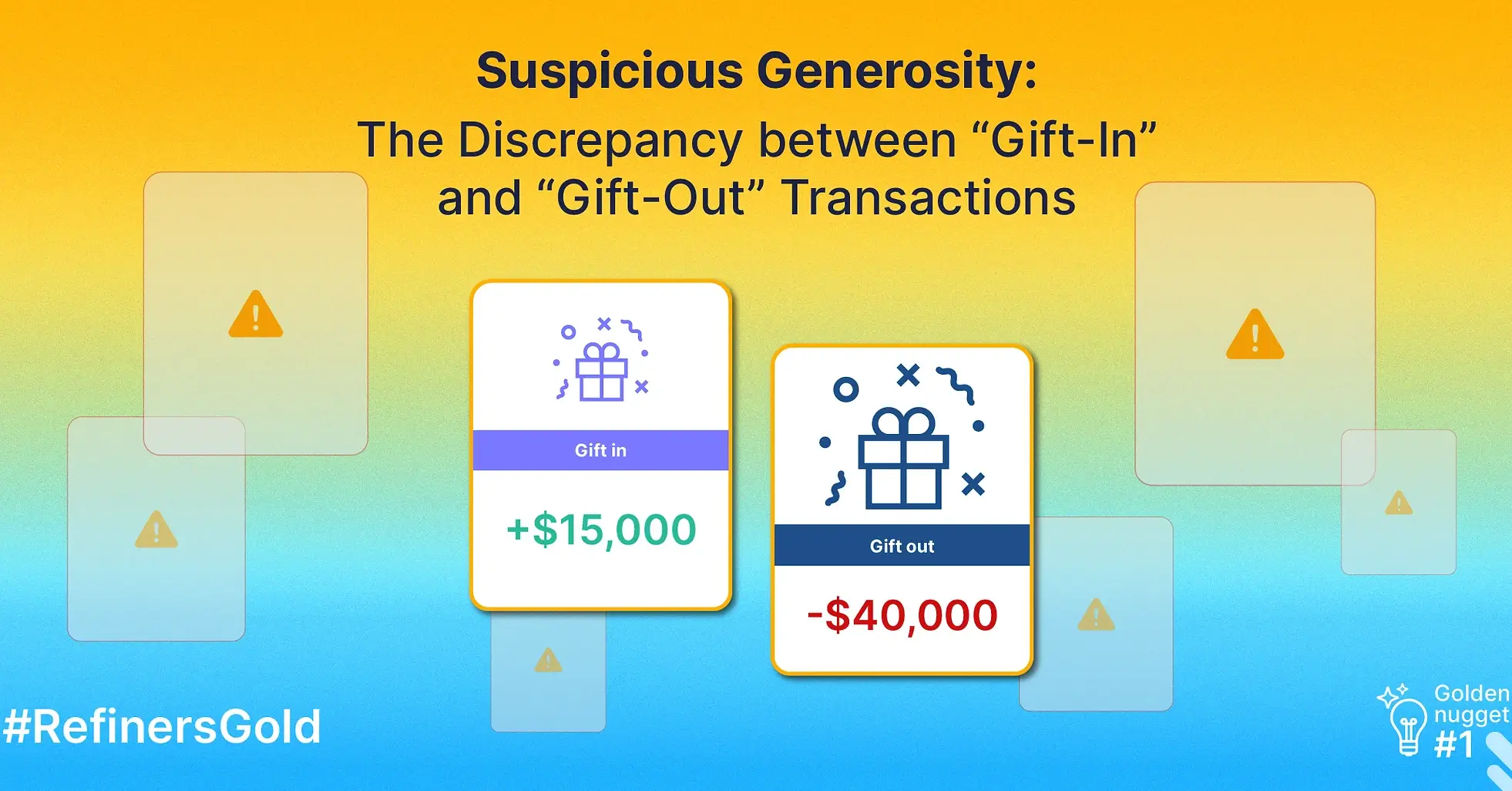

What’s surprising is the huge gap between “gift in” vs “gift out.

When looking at the aggregate for all customers, the median amount for receiving gifts is $15,000, but for “gift out” the number jumps to about $40,000!

Why is there such a huge difference? Why do customers giving a gift have 166% higher transaction amount vs. customers who receive a gift? Aren’t they supposed to be the same?

We’ll keep this as a mystery for now, but there’s actually a very interesting explanation to this discrepancy. We’ll just give you a hint: it has to do with the AGE of the customer.

Then there’s another question: how can we know that customers who SAY the reason for their activity was a gift are really telling the truth? Couldn’t they actually be laundering money?

That’s a great question, and we’ll dedicated episode 2 to that – coming soon!

Meanwhile – stay tuned for more Refiners’ gold, and subscribe to receive them automatically as they get released!