Anti-Money Laundering

for AML Investigation Teams

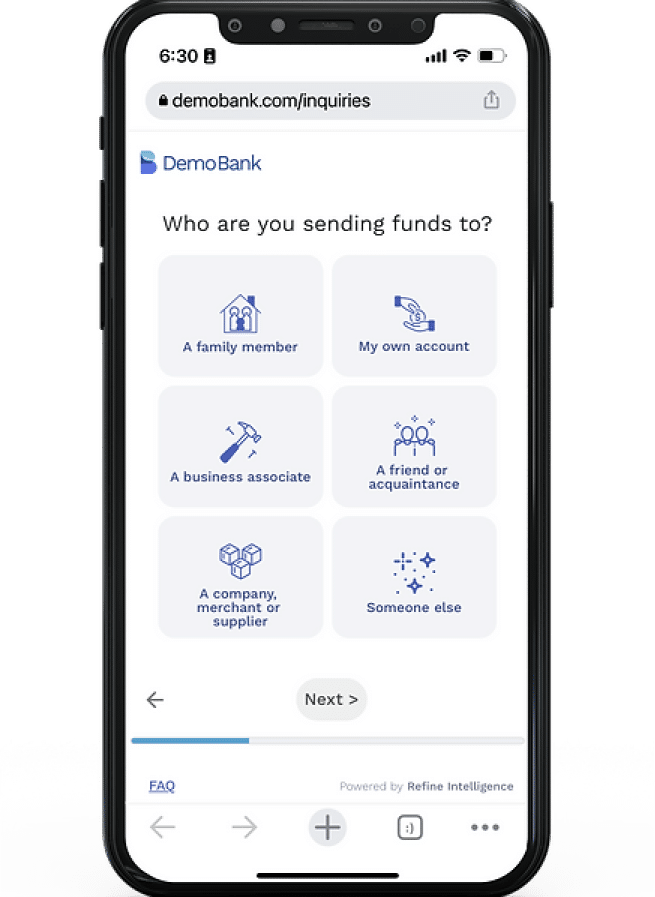

Currently, bank outreach to customers is highly inefficient. Manual outreach via the branch, for instance, takes 16 days on average and 3.6 internal back-and-forth emails to receive a response for a flagged activity, and the process is high-friction, bias-prone, inconsistent and rarely tracked. Refine replaces that process with an automated, 100% consistent digital outreach that goes directly to the customer.

2 Min Response

instead of 2 weeks

Offloads 60%

RFI work from Line of Business

More Explainability

means less risk

Benefits

- Boost completion rates to 85%

- Complete AML outreaches in two minutes

- Receive results instantly in a clear audit trail

- Ensure consistent, objective, structured questions

- Avoid bias, tipping-off risks, and customer friction