Bank Impersonation Attack Prevention

Bank impersonation attacks are skyrocketing. Using AI and automation, criminals are running large, high-quality account takeover schemes. Callbacks by frontline teams or operations are inefficient: customers don’t answer, and outreach is resource-intensive, high-friction, and low-yield.

Refine is a Game Changer.

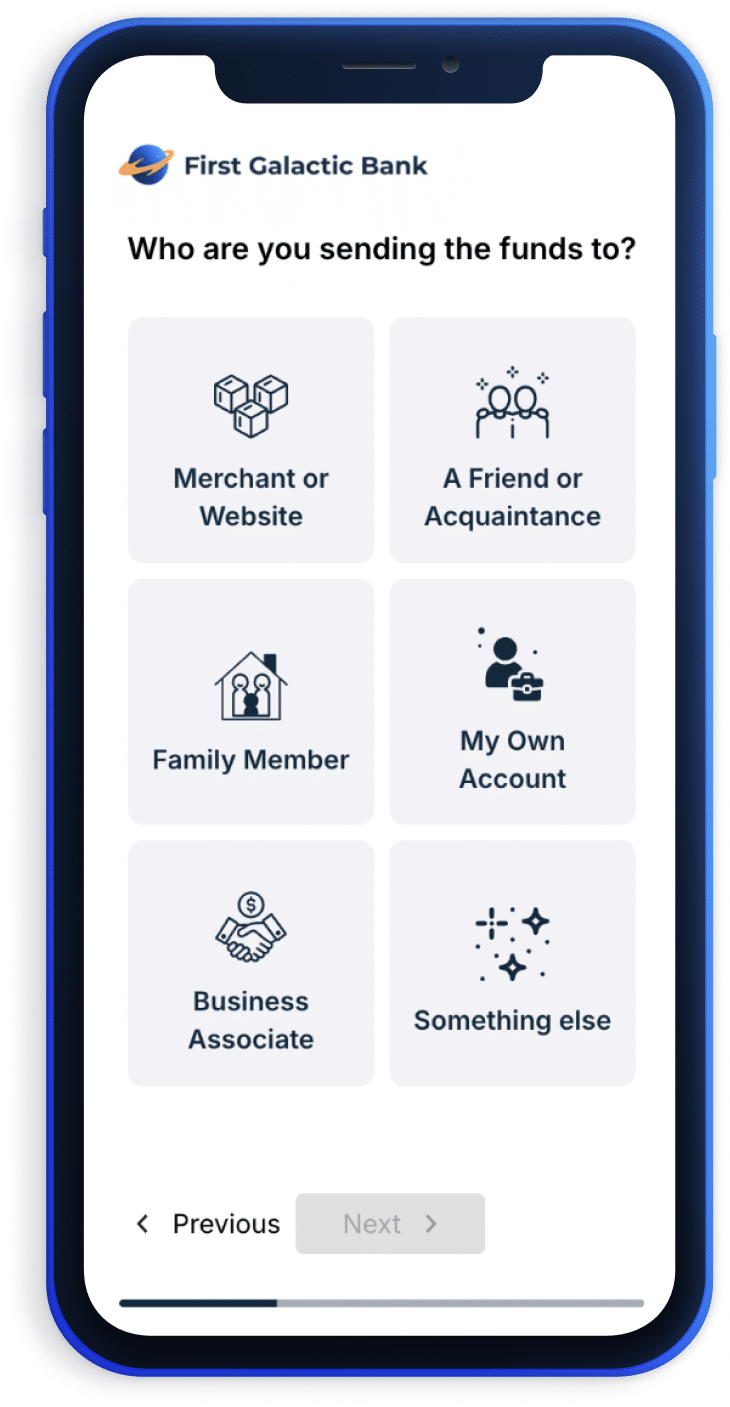

Refine automatically engages customers across multiple channels, asking them to verify suspect wire or ACH transactions and provide context on the beneficiary and the nature of the transfer.

Your frontline and operations teams get time back, and your fraud controls become future-proof, efficient, and accurate.

75% reduction in time spent by frontline/ops on wire/ACH fraud

82% customer response rate